The crypto markets have survived some of the toughest economic conditions in a generation, with a global pandemic, conflict and record inflation crammed into three years. Led by bitcoin and ethereum, the crypto market is enjoying a strong recovery. A common analogy used by investors is this: “A rising tide lifts all ships.” Among the fastest rising crypto sectors is DeFi.

Decentralised finance, or DeFi, is rewriting the book on financial services by reconstructing the entire financial system on decentralised blockchains. It transforms centralised, manual, inefficient financial services into automated blockchain-based programs called smart contracts. For the first time in history, markets don’t need a centralised financial intermediary (known as CeFi, or centralised finance) to connect buyers and sellers. Smart contracts connect them directly.

What some financial services companies take weeks to approve happens at the click of a button, delivered via intuitive applications that are simple to use. This is the power of DeFi, and it’s changing finance as we know it.

The value of DeFi is rising fast

When you consider the nearly US$500-trillion value of the global financial institutions being disrupted, DeFi is just getting started. It’s one of the best use cases for blockchain technology — a natural fit for the world’s new financial needs. In the words of Zhu Su, a leading crypto investor: “You can safely bet on deglobalisation in the physical space and decentralisation in the digital space for the next 500 years.”

How do you tell good from bad in DeFi?

DeFi exists to enable everyday people to efficiently manage their money without relying on financial intermediaries. So, it stands to reason that DeFi projects with large amounts of money committed to them are successful. In traditional finance, assets under management (AUM) is a measure of the total value — in money and investments — that has been committed to a fund, bank, wealth manager or company. The higher the AUM, the more people believe in their respective investment proposition. The same applies to DeFi.

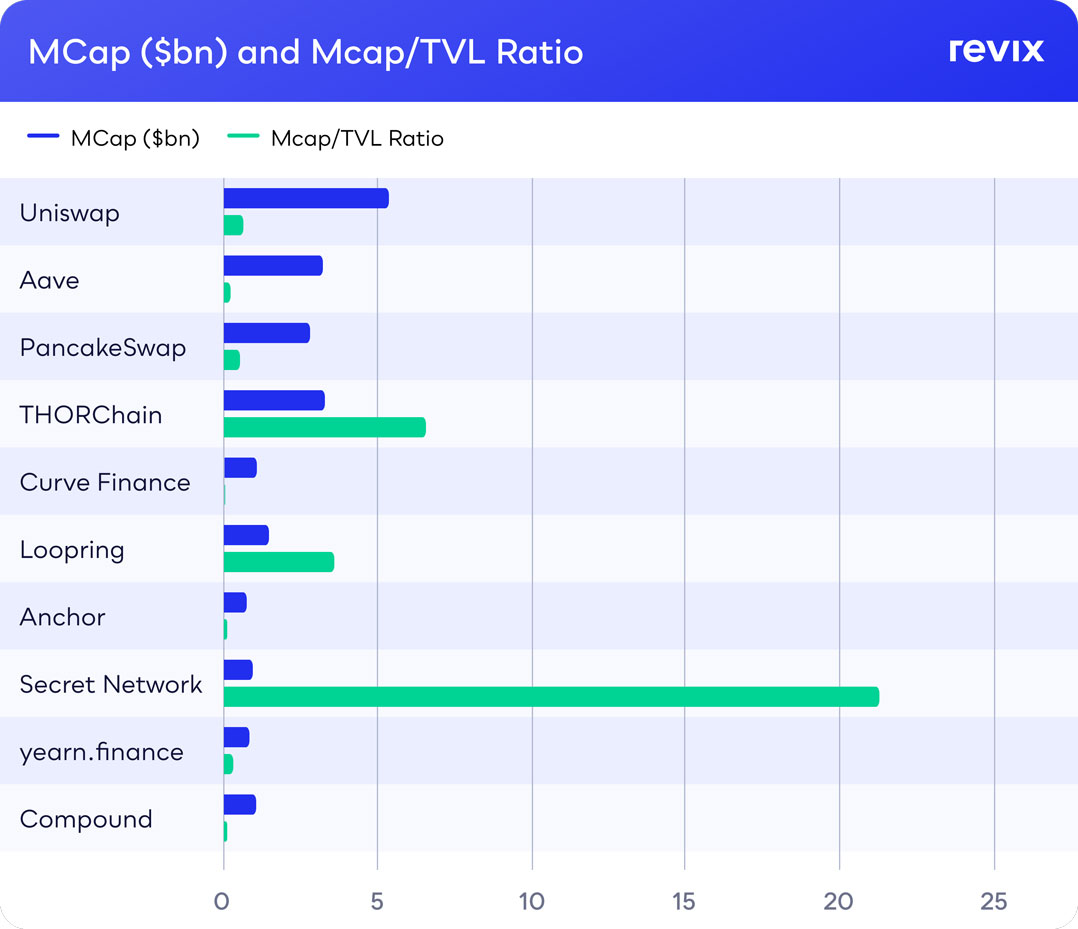

In crypto, the amount of money committed to a DeFi project is called “total value locked” (TVL). The TVL of a DeFi project tells you the total current market value of all the digital assets committed to the project. However, TVL alone is not enough to tell you whether a DeFi project is a good investment. The real insight comes from comparing the TVL to the value of the cryptocurrency itself (the market capitalisation).

The market cap-to-TVL ratio in crypto is the same as a price-to-earnings ratio in traditional finance, helping investors find the market value of a stock. It divides a project’s market cap by its TVL, allowing you to compare apples with apples.

Below you’ll see the TVL to market cap ratios for the DeFi cryptocurrencies that make up the new Revix DeFi Bundle. Low TVL ratios compared to market cap show projects with higher potential for long-term value.

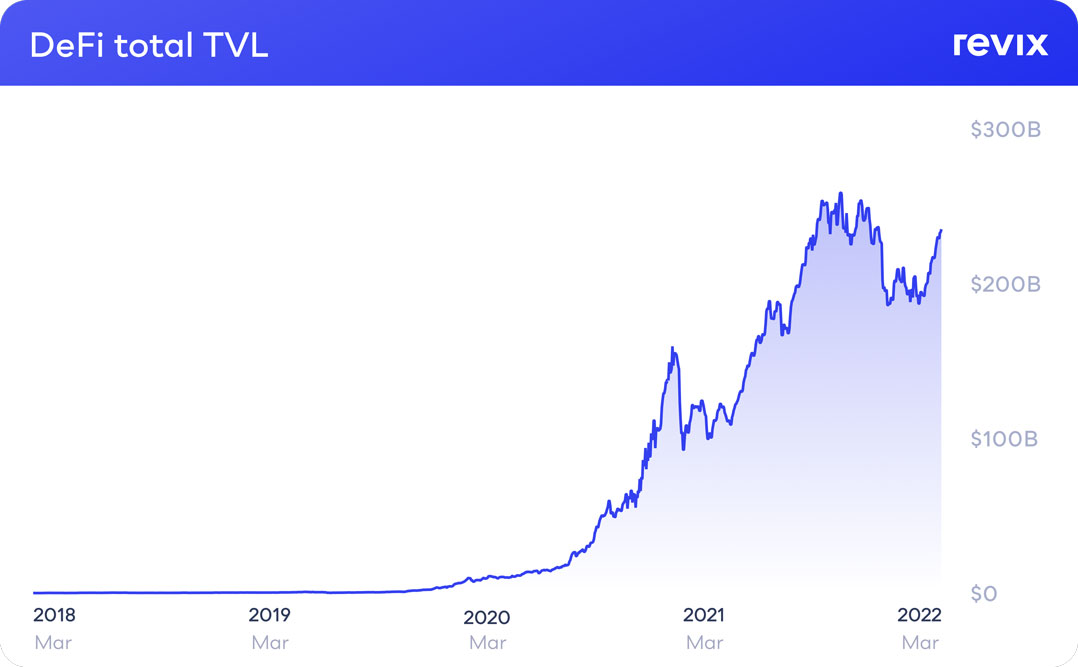

The rate at which the DeFi asset class has grown is dazzling. TVL grew from $700-million in December 2019 to $20-billion a year later. In 2021 the digital assets assigned to DeFi were worth over $250-billion, with new highs on the horizon for 2022.

Being an early investor in disruption of this scale pays outsized dividends. To facilitate this early access, Revix (a Cape Town-based investment platform backed by JSE-listed Sabvest) has built an easy to use and customer-friendly portal to all things crypto. On Friday, 25 March, Revix launched a new themed DeFi Bundle, offering users exposure to the cryptocurrencies building the future of finance.

Make your informed investment before mass adoption.

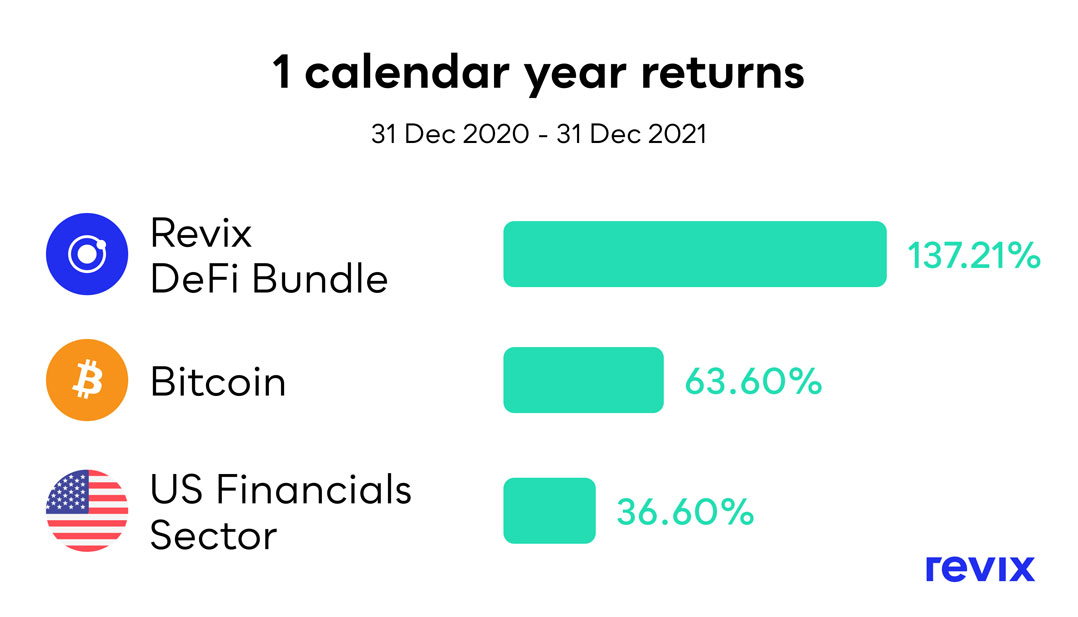

The DeFi Bundle, which saw 137% growth in 2021, offers a selection of the world’s leading DeFi tokens in one convenient investment. Through the DeFi Bundle, you receive exposure to the world’s largest decentralised exchanges, lending platforms and payment platform cryptocurrencies. It’s a lot like buying property off-plan in a great neighbourhood — you know what the end product will look like, and you’re taking a calculated risk on its future value.

The bundle automatically rebalances (meaning it makes slight changes to the weighting and assets in the bundle) on the 1st of every month. It takes advantage of opportunities available from the most reputable DeFi cryptocurrencies through buying or selling each asset. This dynamic and fully automated approach makes investing effortless, maximising your returns and saving you time.

Max your investment with zero fees!

Max your investment with zero fees!

If you invest in the Revix DeFi Bundle between 25 March and 7 April, you won’t be charged any buy-in fees. That means more bundle units for you and higher returns! Invest as much or as little as you’d like with 0% buy fees!

About Revix

Revix brings simplicity, trust and excellent customer service to investing in cryptocurrencies. Its easy-to-use online platform allows you to securely own the world’s top cryptocurrencies in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

Disclaimer

Remember, cryptocurrencies are high-risk investments. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

This article is intended for informational purposes only. The views expressed are opinions, not facts, and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any cryptocurrency.