Information reaching TechGH24 indicate the players in the electronic and digital finance industry were completely unaware about the introduction of the electronic transaction levy (E-Levy) until Wednesday when the finance minister announced it during the 2022 Budget reading.

Prior to the Budget reading, checks by TechGH24 across the industry indicated that none of them knew about it because government had not given them any prior notice, even though they are to be the main implementers.

Initially, it was rather rumored that government was planning to place a tax on the interests that mobile money customers get from their wallet balances. Nothing was said about electronic transaction taxes.

TechGh24 can confirm that government will, for the first time, be meeting the industry players on Friday, November 19, 2021 to now discuss what exactly the tax entails, how it should be calculated and implemented.

Those to attend the meeting include telcos, Fintechs, and representatives from the National Communications Authority, Ghana Revenue Authority, Bank of Ghana, Ministry of Communications and Digitalization, and the Ministry of Finance in the main.

Finance Minister Ken Ofori-Atta announced a 1.75 per cent E-Levy on all electronic transactions, including mobile money, beginning January 2022, saying that Covid-19 and government’s digitalization program have boosted digital finance transactions exponentially, and it has now become necessary to tax those transactions.

The Minister said the plan is to rope in the informal sector into the tax net because a lot of financial transactions in that sector now take place on digital platforms via mobile money and other electronic wallets.

But there is an exemption on any amount from GHS100 and below transacted per day. This is a pro-poor policy designed to cushion the less privileged who often transact smaller amounts from the E-Levy.

According to the Minister, the expected proceeds from the E-Levy will take care of the abolished road toll for roads maintenance, plus part of it will be used to support entrepreneurship, youth employment, cyber security and digital infrastructure among other things.

A similar promise was given regarding the use of Communications Service Tax (CST) when it was increased to nine percent pre-Covid. This was before it was reduced to five percent during the Covid outbreak.

Also Read: Government slaps 1.75% E-levy on MoMo, electronic transactions

E-Levy will cover road tolls – Adu-Boahen

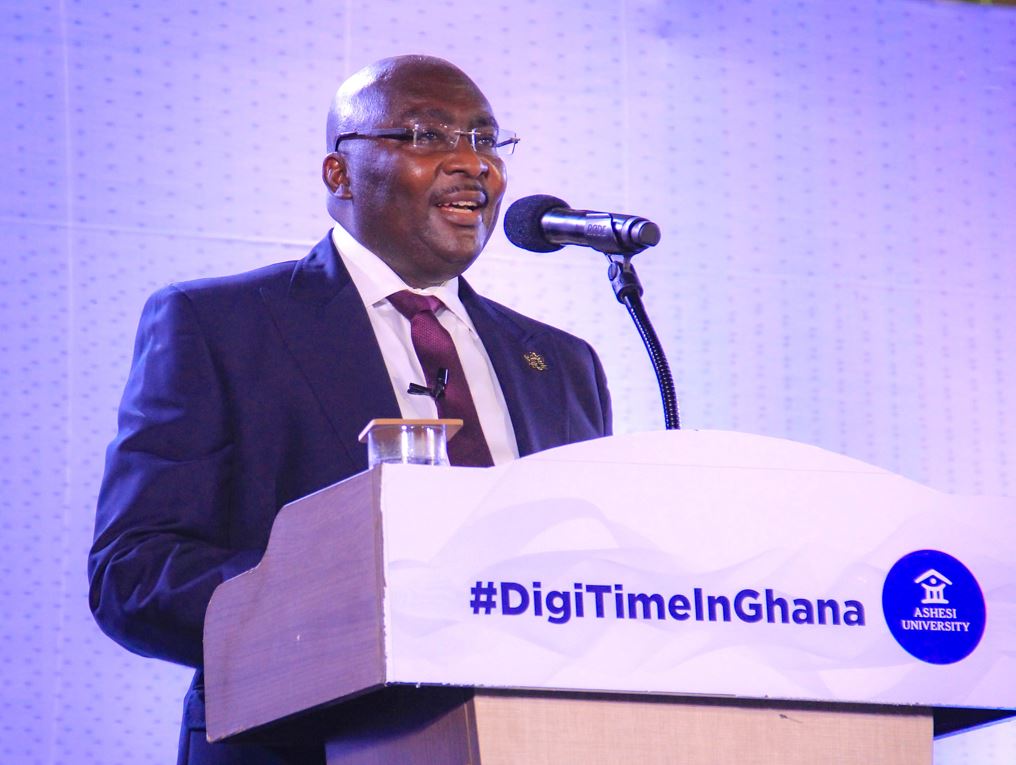

Bawmunia

Meanwhile, just in August last year, the champion of Ghana’s digitalization journey, Vice President Dr. Mahamudu Bawumia did state that he did not believe mobile money should be taxed because most of the people who use mobile money are poor people.

According to him, the idea is to rope more Ghanaians, particularly the unbanked into the financial sector and so if government begins to burden those people with taxes, it will defeat government’s own financial inclusion agenda.

Prior to the Vice President saying that, the communication and digitalization minister, Ursula Owusu-Ekuful had been campaigning for the mobile money service charges to be taxed.

The Minister, at the time stated that the telcos earned some GHS71 million every month in mobile money service charges and she believed that money should be taxed separately.

She did explain that the intent was not to tax mobile money service, which was going to burden the users, but just the service charges that went to the telcos.

Meanwhile, leading civil society organization, CDD-Ghana did criticize the Minister’s suggestion at the time, saying that if the service charges are taxes, the cost will eventually be passed on to consumers.

They explained that telcos already paid corporate taxes on the revenue they make from mobile money service charges, so an additional tax will be double taxation and the consumer will eventually suffer for it.

Now the mobile money service tax is here and the only comment coming from industry players is “the days ahead will be very interesting”.

Vodafone Cash Free Transfer

It, for instance, remains to be seen how this new tax will affect the award-winning novel completely free money transfer from Vodafone Cash to wallets on all other networks.

Already, Vodafone Cash has sacrifices millions on behalf of their customers for more than year. But would the telco continue to absorb the service charges even after the 1.75 per cent tax is implemented?