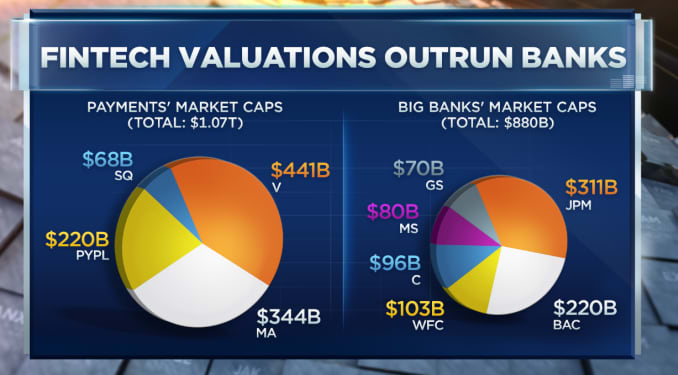

There may be a changing of the guard underway in financials as the value of Fintech companies begin to top that of traditional banks.

The market caps of payment stocks like Visa and MasterCard have eclipsed the value of Wall Street’s biggest banks, even as their balance sheets remain significantly smaller in comparison.

A large portion of gains in market value have come in 2020, as investors continue to reward software-based tech companies amid the pandemic. The ETFMG Prime Mobile Payments ETF, which tracks mobile payments stocks, is up nearly 10% in 2020, while the Financial Select Sector SPDR Fund is down nearly 20% so far this year.

Meanwhile, shares of traditional Wall Street banks have come under pressure amid low interest rates and fears of rising loan defaults as the economy continues to suffer during the coronavirus pandemic.