The Competition Commission of South Africa has okayed the sale of over 5,000 MTN towers to IHS Towers, but has attached stringent conditions to prevent anti-competitive conduct.

The commission said that the sale of 5,713 “passive tower infrastructure sites” by MTN could go ahead. However, it said the transaction raises various competition and “public interest” concerns.

It said it has concerns about the possible exclusion of rival independent tower operators and vendors from the market, as well as the potential exclusion of rivals from access to space on the affected towers.

“The commission was particularly concerned about the ability of SMME (small, medium and micro enterprises) and HDP (historically disadvantage person) tower vendors and independent tower operators to effectively participate in and expand in the tower infrastructure market, particularly at a time when mobile operators are considering the technical and other imperatives of rolling out 5G technology,” it said in a statement.

The commission has therefore imposed several conditions:

- MTN may not retrench any of its employees in South Africa as a result of the merger for a period of 24 months from the implementation date.

- Within 18 months, IHS South Africa must achieve a minimum black economic empowerment status of level 4 or better. This must reach level 1 within four years. Also, within 24 months, the company must have 30% black ownership.

- MTN must spend R60-million (US$4 million) a year for 10 years to support SME and HDP-owned vendors in the telecommunications sector. This amount will expand by the consumer inflation rate in each year for 10 years.

“Further particulars of the [black economic empowerment] conditions are subject to a confidentiality claim made by the merging parties. The merging parties’ confidentiality claim will be adjudicated by the Competition Tribunal,” the commission said, without elaborating on the reason for the confidentiality.

IHS South Africa and MTN must also procure a substantial proportion of the goods and services required for the construction of its tower sites as well as the management, maintenance and security of tower sites from small businesses and black tower vendors in South Africa. This condition is in place for a period of 10 years. The vendors chosen must also be given preferential payment terms to support their “working capital requirements”.

In addition, the regulator said there is a structural link between MTN South Africa and IHS South Africa, which “raises a concern” that IHS may be the preferred partner for new site roll-outs.

“To limit any exclusionary effect associated with such a strategy, the commission has imposed a condition limiting preferential allocation of MTN’s new site roll-out in terms of both the number of sites and the period in which IHS South Africa may be given first preference for new site roll-outs.”

Then, for the towers it’s buying from MTN, IHS must make the sites available to all existing users on the same terms and conditions as are currently applicable.

“On the expiry of those agreements, in relation to both the tower sites being acquired and any new sites constructed by the IHS Towers, IHS will, on request, provide services (including, but not limited to, lease space on towers) to any party licensed in terms of the Electronic Communications Act (including existing users) on fair, reasonable and non-discriminatory terms, provided that it is technically, commercially and legally feasible to do so, and subject to performance by the third parties of their respective obligations under the applicable commercial agreements.”

These conditions “will endure for as long as the IHS Towers is a site owner in South Africa”, the commission said.

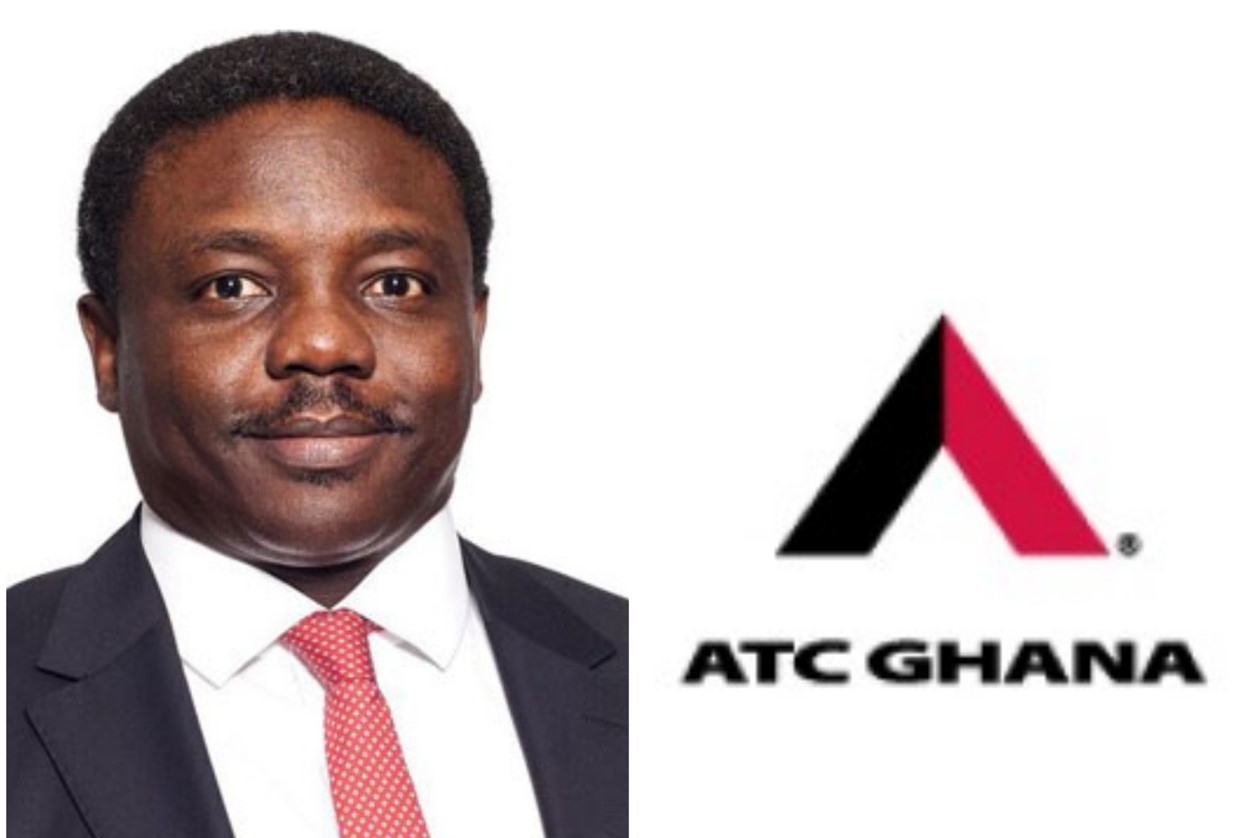

Ghana (MTN and ATC Ghana)

In Ghana, telcos, including MTN, sold their towers to independent towercos with lease-back arrangement while the regulator looked on unconcerned.

As a result, one of the independent towercos, ATC Ghana, which bought most towers from MTN has become an ally of MTN and is allegedly implementing policies that shortchange other players and favors MTN.

What even further cements its marriage with MTN is that a lot of the MTN staff who used to an the towers before they were sold to ATC Ghana, have also joined ATC Ghana and they continue to pursue policies that favor their former paymasters.

ATC Ghana controls about 85% of co-location towers and over 60% all towers in the country, which makes them a significant market power (SMP) in that space, and yet the regulator has not bothered to name them as such and apply the necessary remedies.

It would appear the telecoms regulator in Ghana is only keen on regulations that bring it money, but not equally keen about regulations that ensure fairness and protection for consumers and smaller players in the industry.

As things stand now, MTN benefits from the lease-back agreement it has with ATC Ghana, plus, it has men inside ATC Ghana whose orientation is to work for their former paymasters, while the smaller operators who do not have any men inside get shortchanged by unfair policies.

At least Ghana’s industry regulator can learn some lesson from the Competition Commission of South Africa and institute some measures to remedy the situation.