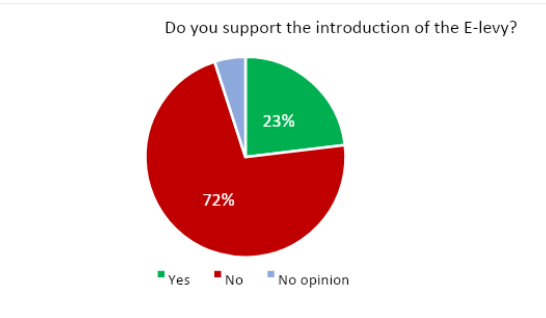

A survey on the controversial e-levy by Ghanaian research firm, Global InfoAnalytics, shows that 72 per cent of eligible voters are opposed to it and only 23 per cent of same said they support it.

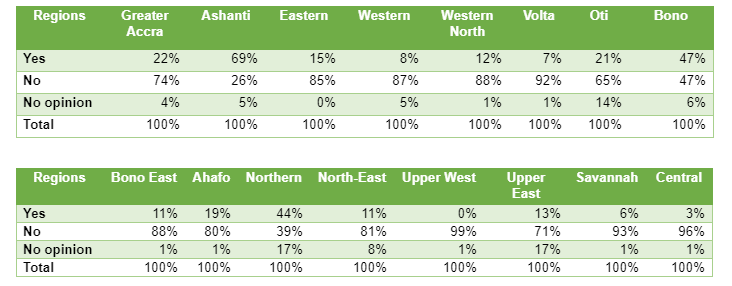

Meanwhile, the regional analysis of the implementation indicated a rather interesting trend – a massive opposition of the e-levy in President Nana Addo Dankwa Akufo-Addo and his Finance Minister, Ken Ofori-Atta’s home region, the Eastern Region.

Per the report, a whopping 85% of those surveyed in the Eastern Region were opposed to the E-Levy. But it was even worse in some other regions – Upper West topped with 99% opposing the bill, followed by Central, 96%, Savannah, 93% and Volta 92%.

For the swing regions – Central and Western Regions – through which he won the 2016 and 2020 elections, 96% and 88% of those surveyed respectively, said “No” to the implementation of the e-levy.

Only Ashanti region supports the E-levy with 69% supporting it and 26% opposing it. Opinion in the Bono region is equally divided as “Yes” attracted 47% and “No” 47%.

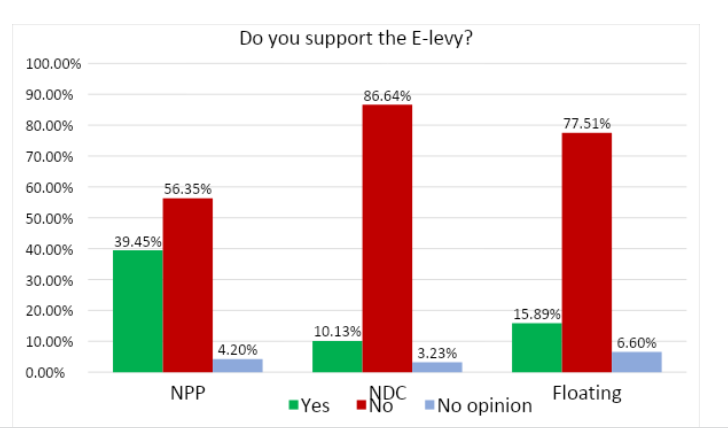

On the lines of partisanship, the survey conducted revealed that, while 86.6% of the members of the National Democratic Congress (NDC) are opposed to the levy, 56% of the members of the ruling New Patriotic Party (NPP) are also opposed to the levy.

The 1.75% (now 1.5%) E-levy proposal in the 2022 budget statement has sharply divided Parliament and the entire country. Opposition MPs have rejected the proposal and sworn never to support the passage for the law for its implementation.

Meanwhile, the government is currently on a series of townhall meeting across the country trying to convince Ghanaians to accept for virtually every transfer they make from the mobile wallets to be taxed.

The chief argument against the e-levy is that the government has no justification in slapping it on every single Ghanaian if it claims the target is people doing online business who are outside the tax net.

The government needs to properly identify those doing business and tax them, because a wholesale implementation means they are putting their hands in people’s pocket to tax moneys on which individual may have paid taxes already.