A personal quick loan app called DatesCash on both Google Play and Apple stores is in the practice of imposing loans on app users and demanding ridiculously high interest rates from them within very short periods.

This came to light when a new user of the App, Aluizah Amasaba received GHS65 from DatesCash into his Vodafone Cash wallet just after he signed on to the App on March 18, 2023, even though he did not request for a loan.

Aluizah told Techfocus that because he did not request for any loan, he did not even realize at the time that they had deposited GHS65 into his wallet until six days later, on March 24, 2023 when he received notification from DatesCash saying he had to refund GHS104, which means he was to refund the loan with almost 60% interest.

According to him, he then got a call from a lady with an MTN number – 0596921581 – who said she was calling from DatesCash. The lady told him to repay his loan and qualify for bigger loans or else the interest will keep rising until he refunds the initial GHS65 with the stated interest.

Aluizah confronted the lady as to why they sent him loan without him requesting for it, but the lady could not provide any reasonable answer. Indeed, true to Aluizah’s testimony, Techfocus wrote to DatesCash via their WhatsApp account – +2349112386164 – requesting specifically for the proof of Aluizah’s request for a loan. What DatesCash sent to us was just proof of Aluizah signing on to the App, but not a request for loan.

After the phone conversation with the lady, Aluizah said he cashed out all the money in his wallet to ensure it was safe. He has since been calling that MTN number – 0596921581 to request for a mobile wallet he can send their GHS65 to, but that number does not ring.

What has rather happened is that, subsequent to the call from the lady, on March 29, 2023 – five days after Aluizah got the last notification to pay GHS104, DatesCash sent another notification saying the amount refundable has now increased to GHS116 plus, which shoots the interest rate up to a ridiculous 80%.

Privacy Breach

As if that is not bad enough, the App, which operates from Nigeria, is also built to automatically extract very private information from users’ phones before one is allowed to signed on.

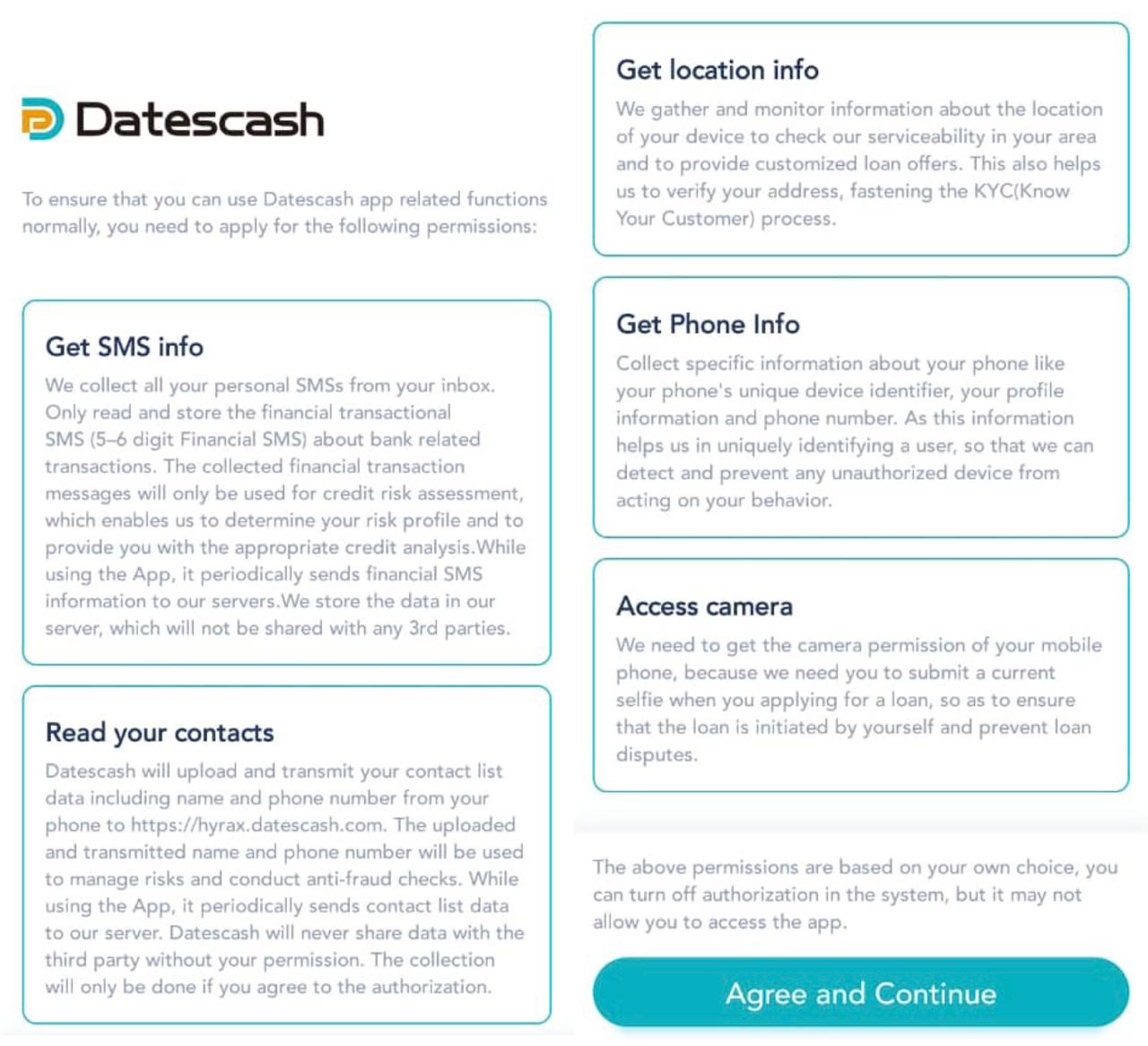

At the point of signing on to the app, you are informed of all the private information they will extract from your phone once you sign on. If you refuse to agree to the breach of your privacy they will stop you from signing on.

They ask you to agree to them extracting phone contacts with names, accessing your phone camera, unique device identifier, profile, live location at all times, all your personal SMS, details of financial transactions on your phone, and much much more. Check the picture below:

Also Read: Google bans personal loan apps from accessing user contacts

As stated above, Techfocus has reached out to DatesCash and they had no valid explanation to why they give loans to users without the user first requesting for the loan, as required by the banking laws of every country.

Secondly, they remained totally silent on why users would have to agree to such conditions that allow the App to pry into people’s privacy.

Public Warning

Meanwhile, the Bank of Ghana and the Cybersecurity Center of Ghana had in the past issued a number of public notices separately, warning the public to desist from these loan apps which are not licensed to operate in Ghana and whose policies violate the banking laws and cybersecurity policies of the country.

The Central Bank for instance, listed at least 19 of such illegal apps and warned Ghanaians to steer clear of same.

The 19 were SikaPurse Quick Online loan, 4Cedi Instant Mobile loan application, Zidisha Online Loans, GhanaLending Application, ChasteLoan Application, LoanClub-Ghana Instant Loan, AdamfoPa Loan, MetaLending – Instant Cash Loan, Wohiasika Loan (Ghanaloan.net) and Boseafie – Bosea Micro-Credit.

The rest are SikaKasa Online Lending, LoanPro – digital and instant loan, SikaWura Loan Application, BegyeBosea Loan, LendingPapa – Online Loans, CrestCash Loan, Credxter – Loans and Hire- Purchase, MobiLoan Application and Cedi Now – Cash Loans Application.

Pseudo Names

But some of the unlicensed loan apps now disguise themselves with pseudo names and they get connected to licensed payment services providers (PSPs) as merchants, so the PSPs are often unable to tell that those pseudo names are actually linked to the illegal loan apps.

But the Bank of Ghana had had reason to penalize some PSPs in the past with cash fines for failing to do due diligence on the merchants they sign on to their payment gateways. It would appear that the PSPs are focused more on the financial gains in signing on more merchants, so they do not do their background checks, which include reaching out to the regulator to confirm the legitimacy of some of the merchants.

It is not clear which PSP’s payment gateway DatesCash for instance uses, but they keep doing business from Nigeria into Ghana and the app still remains active till date. They still advertise that they can give up to GHS1,000 quick loan in 5 minutes.

Bank of Ghana has however taken note of the operations of DatesCash and other unlicensed digital lenders like it, which are still operating in the country.

Techfocus is reliably informed that going forward, there are strategies being put in place to ensure that such illegal digital lenders will not only be stopped from operating, but they will face prosecution both home and abroad so they know they can no longer run and hide anywhere on the globe.