The leading association of global chip companies is warning that Huawei Technologies Co. is building a collection of secret semiconductor-fabrication facilities across China, a shadow manufacturing network that would let the blacklisted company skirt US sanctions and further the nation’s technology ambitions.

Huawei, a controversial telecommunications gear maker at the heart of US-China tensions, moved into chip production last year and is receiving an estimated $30 billion in state funding from the government and its hometown of Shenzhen, according to the Washington-based Semiconductor Industry Association. It’s acquired at least two existing plants and is building at least three others, the group said in a presentation to its members seen by Bloomberg. Huawei has not disclosed its role in this expansion, according to people close to the SIA, who asked not to be identified sharing non-public information.

The Commerce Department’s Bureau of Industry and Security, in response to questions from Bloomberg News about the SIA warnings, which haven’t been previously reported, said it’s monitoring the situation and is ready to take action if necessary. It has already blacklisted dozens of Chinese companies beyond Huawei, including two the SIA says are part of Huawei’s network — Fujian Jinhua Integrated Circuit Co. and Pengxinwei IC Manufacturing Co., or PXW.

“Given the severe restrictions placed on Huawei, Fujian Jinhua, PXW and others, it is no surprise that they have sought substantial state support to attempt to develop indigenous technologies,” BIS said in a statement to Bloomberg. “BIS is continually reviewing and updating its export controls based on the evolving threat environment and, as evidenced by the Oct. 7, 2022 rules, will not hesitate to take appropriate action to protect US national security.”

The Biden administration levied export controls last October that prevent all Chinese companies from acquiring certain advanced semiconductors and chipmaking equipment, a move aimed at restricting the country’s military capabilities. Chinese companies are largely allowed to buy older-generation chipmaking equipment, machines that use 28-nanometer technology or above. But blacklisted companies like Huawei are prohibited from such purchases without a license and those exceptions are rare.

“These developments were already publicly reported on by multiple media outlets months before SIA simply highlighted these news items at an association meeting discussing market trends,” the SIA said in an emailed statement.

Certain members of the lobbying group will face competition from Chinese rivals if they’re successful in building domestic production facilities, but SIA members like ASML and Nvidia Corp. lose revenue from China as American export controls become stricter. The association may be trying to warn members to be cautious in working with companies that could have hidden ties to blacklisted entities like Huawei.

Under BIS regulations, American suppliers have “know your customer” obligations that require them to check into clients if there are any suspicious circumstances, like purchases inconsistent with the customer’s needs.

“If there’s a red flag, then you have an obligation to investigate,” said Kevin Wolf, a partner with the law firm Akin Gump who worked on BIS policy at the Commerce Department. “Absent a red flag, there is no affirmative duty to verify or go beyond the company’s representations.”

The SIA presentation has set off alarm bells at member companies and within the Biden administration since it was published in April. The US is weighing more stringent export controls on China.

China’s Communist Party has blasted the American government for its restrictions on technology exports to the country, arguing the US is trying to contain its economic development. Beijing has also vowed to develop its own local alternatives for chips, production machinery and critical tech components.

China is pouring unprecedented amounts of money into its domestic semiconductor industry. The SIA estimates there are at least 23 fabrication facilities in the works in the country with planned investments of more than $100 billion by 2030, according to the presentation. By 2029 or 2030, China is on track to have more than half the industry’s global capacity in older-generation semiconductors, those made with 28-nm or 45-nm technology, the group said.

“China is roughly spending as much in subsidies as the rest of the world combined,” said Chris Miller, author of “Chip War: The Fight for the World’s Most Critical Technology.” “So the numbers are absolutely enormous.”

US and European officials have grown increasingly concerned about China’s massive investments in so-called legacy chips, even though they are not prohibited under last year’s Biden rules. Such chips are more than adequate for many military applications, and they’re widely used in key markets such as electric cars.

The SIA described the money as “state funding” without specifying whether that would be cash grants, loans or other incentives. It’s not clear whether the troubles in China’s economy in recent months will affect the government’s technology investments.

Huawei’s push into Chips

The leading US chip association says the Chinese telecom company is moving into semiconductor production.

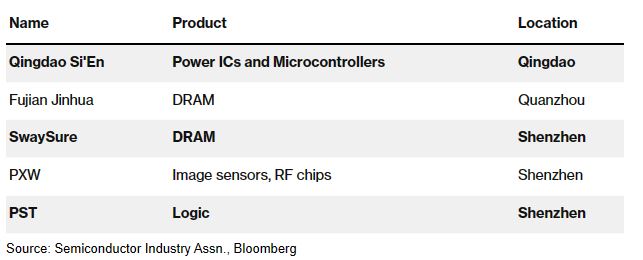

For example, Huawei acquired fabrication facilities, or fabs, from Fujian Jinhua and a company called Qingdao Si’En, the association said. It’s also helping to build fabs with companies such as PXW and Shenzhen Pensun Technology Co., or PST, the association said.

Fujian Jinhua was blacklisted in 2018 as a threat to US national security and sued for allegedly stealing trade secrets, charges it has denied. Bloomberg News reported on PXW’s ties to Huawei in October, including that the low-profile firm is run by a former Huawei executive and that it constructed facilities close to Huawei’s primary offices,

If Chinese companies are using American equipment or machines with substantial American inputs, they would typically be obligated to get a US license before supplying a company like Huawei. But it can be difficult to enforce the BIS rules outside the US, said Wolf of Akin Gump.

“For those that don’t want to comply, it’s very hard to find,” he said.

One long-term risk from the US standpoint is that Huawei and other Chinese companies will use investments in older-generation technologies to build knowledge and expertise in semiconductor manufacturing. With enough experience and production volume, a company with Huawei’s technical prowess could advance to more sophisticated semiconductors.

That was the path followed by TSMC and Samsung, which were once dismissed as having no hope of catching the likes of Intel. Now, after decades of work, they lead the industry in producing more and more sophisticated chips.