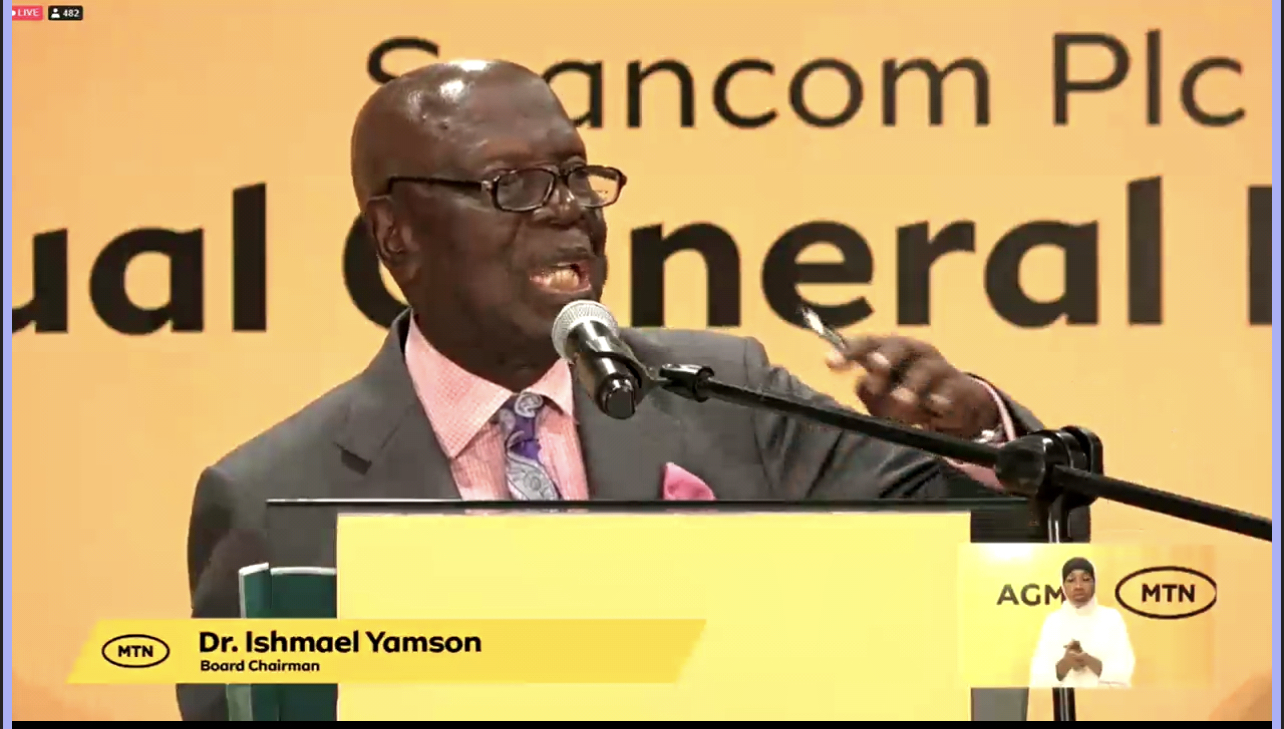

MTN Ghana has declared GHS0.115 dividend per share for the year 2021, and the Board Chairman, Ishmael Yamson says that means the company is paying out some 70.3 per cent of its profit after tax to shareholders.

He was speaking at the 4th Annual General Meeting of MTN Ghana since it became a public listed company four years ago.

The Chairman stated that profit after tax grew by 43% year on year to GHS2 billion in 2021, adding that the company therefore proposes to pay GHS0.085 dividend per share in addition to the GHS0.030 paid mid-year, making the total dividend per share for the year GHS0.115.

He noted that in the year under review, the world and Ghana continued to reel under the several consequences of Covid-19, which started as a health crisis but quickly turned into an economic, social and political one, with seven million deaths globally, food shortage, high inflation, loss of jobs and several other challenges.

In the midst of all those challenges, Ishmael Yamson noted that MTN Ghana continued to be the highest taxpayer in Ghana as it has always been over the years – paying some GHS3.1 billion taxes, out of which some GHS2.3 billion was direct and indirect taxes.

He said the taxes paid by MTN in 2021 constituted 43% of its total revenue for the year, and a significant portion of Ghana’s GDP, impacting over 500,000 Ghanaians in terms of direct and indirect jobs.

Mr. Yamson said in the year under review, the MTN Ghana Foundation spent a significant GHS14.3 million on various high impact projects in education, health and economic empowerment, particularly in the area of digital skills empowerment.

According to him, the company has earmarked some GHS20 million for corporate social investment in the year 2022 and they have already started rolling put projects in that respect.

Performance

Chief Executive Officer of MTN Ghana, Selorm Adadevoh said in the year under review, Capital Expenditure (CAPEX) was GHS1.5 billion mainly to improve the network and quality of service and experience for customers.

He explained that during the period – 4G network coverage was improved to over 90 per cent with an addition 1,446 sites to reach an extra 1.7 million people with 4G. Additionally, the company added on 131 2G sites, 130 3G sites, while some 1,200 sites were modernized to improve customer experience.

The CEO said during the year, service revenue grew 28.5 per cent year-on-year, driven mainly by a 58% growth in data revenue (adding 36% to service revenue), 38% growth in mobile money revenue supported by some 4.9% growth in voice revenue. Meanwhile, the company saw one million additional subscribers and a significant rise in the number of smartphones on its network in 2021.

According to the CEO, Covid-19 gave rise to the use of digital channels to interact with customers and made life even easier for customers while growth data usage exponentially, hence the growth in data revenue.

Meanwhile, digital revenue grew 5.1% to GHS2.2 million, with entertainment content alone adding some 1.1 million new customers to grow the total to 2.4 million.

Selorm Adadevoh said so far, MTN has reach 23.7% localization but the target is 30% so they are quite close as they continue to pursue strategize to reach the target. Indeed, the company has amended its constitution in order to increase staff shares in the company from 4.4% to 5%, all in pursuit of the 30% localization.

Again, the constitution was amended to add an additional member to the Board of Directors, in the person of the newly appointed Chief Finance Officer, Antoinette Kwofie, to make 13 members.

E-levy

The CEO said E-levy is early days yet so MTN has been observing the short-term impact and strategize to safeguard its stakeholders, adding that their eyes are on the possible medium-term impact and they are strategizing to ensure the best for stakeholders.

There were concerns that e-levy has impacted the share price of MTN on the stock market, but the CEO explained that the behavior of equity shares on the stock market is more of a function of global event – mainly the Russia-Ukraine war – rather than e-levy.

“We don’t think e-levy is necessarily the cause of the reduction in share prices, as there was a global decline on equity stock prices due mainly to Russia-Ukraine war and other factors rather than e-levy – rise in interest rates also affect equities and not e-levy.