Companies quoted on the Nigerian Exchange reported a healthy cash balance of N1.8 trillion (US$3.91 billion) at the end of March 2023 a significant rise from the N1.2 trillion (US$2.6 billion) reported in the same period in 2022, and higher than the total cash balance at the end of 2022 – N1.65 trillion (US$3.58 billion).

This is from Nairametrics’ tracking of the performance of 30 of Nigerian companies operating in the construction, oil and gas, manufacturing, agriculture, real estate, and technology sectors also known as COMARTs. The data excludes commercial banks.

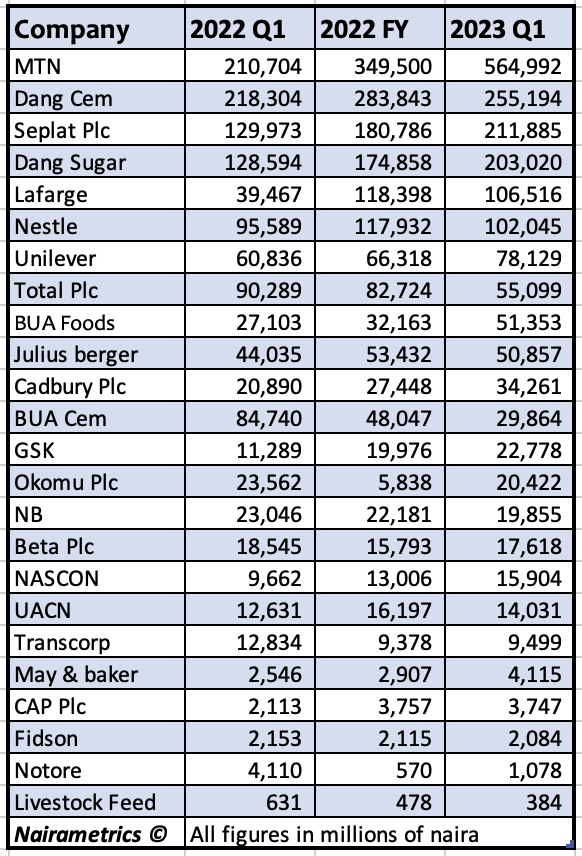

On top of the pack is MTN Nigeria with a cash balance of N564,992 million (about US$1.23 million) in 2023 Q1, which is the largest cash reserve on the list. The company’s cash position has more than tripled over the past two years, from N348,064 million in 2021 Q1 to N166,651 million in 2022 Q1 and finally to its current level.

MTN is followed by Dangote Cement, owned by Nigerian billionaire Aliko Dangote. The company reported a cash balance of N255,194 million in 2023 Q1, up from N194,466 million in 2022 Q1 and N147,871 million in 2021 Q1. Dang Cem has consistently been one of the largest cement producers in Nigeria and Africa.

Indeed, Dangote Sugar Refinery was also in the top five at number four, right behind Seplat Petroleum Development Company. Also in the top five is Lafarge Africa.

The the other five in the top ten are Nestle Nigeria at number 6, followed by Unilever, Total Plc, BUA Foods and Julius Berger.

Find more companies on the list below:

Overview of the data

The cash balances of companies include cash generated from operations, which is cash collected from their customers after deducting the amount paid to suppliers.

It also includes cash generated from bank loans after paying debt servicing and finally, the cash generated from the sale of investments after netting off cash spent on new investments. This is also added to cash in the bank from the start of the year.

During the quarter, companies, 24 of them, generated a total of N444 billion from their operations, suggesting most of the cash balances were from the balance generated a year ago.

Total loans including short and long-term loans were N3 trillion as of March 2023 compared to N2.6 trillion same period last year, suggesting the companies took on more debt to shore up their financial muscle. About N1.6 trillion of the total loans borrowed as of March 2023 were long terms loans.

In terms of the amount spent on investments, the companies spent a net N221 billion in the first quarter compared to N732 billion in the corresponding quarter of 2022 suggesting that companies cut back on spending this year. A major reason for the drop was MTN which spent a net N246.3 billion on investments in 2022 first quarter compared to N76 billion this quarter.