The company which did the tax assessment that led to the Ghana Revenue Authority (GRA) slapping MTN Ghana with the controversial GHS8 billion tax liability is Safaritech Ghana Limited, a subsidiary of Safaritech Kenya Limited, which claims its headquarters is in the United Kingdom.

On its own website (www.safaritech.biz), Safaritech named International Monetary Fund (IMF), the World Bank and USAID as sponsors, and also claimed it is “a base for the IMF, UNDP, GIZ, USAID and ARTN” in developing countries.

In selecting Safaritech, the GRA had to ditch the work of KPMG, whose work the GRA and telecom industry regulator, National Communications Authority (NCA) had, on a number of occasions, depended on for revenue assurance in the tech industry among others.

In fact, in this particular MTN case, KPMG did a separate independent assessment that was at variance with the work of Safaritech and the GRA decided to ditch KPMG and take that of Safaritech.

It is not clear what methodology KPMG used, but per the notice GRA served MTN regarding the GHS8 billion tax liability, Safaritech audited CDRs (call data records) plus other data to arrive at the conclusion that MTN Ghana hid 30% of its revenue from government between 2014 and 2018.

Again it is important to note that GRA ditched KPMG for Safaritech, an IMF-sponsored agent, at a time when Ghana has gone to IMF with cup in hand begging for $3 billion to deal with the country’s bankruptcy. It would therefore appear that Ghana is under pressure to implement the audit report of an IMF-sponsored and preferred agent rather than that of the highly-reputed KPMG.

What is also not clear is how much Safaritech was paid and by what method they were or are being paid. In previous instances, the GRA had paid such contractors a percentage of the incremental revenue discovered. So in this case, Safaritech may be entitled to a percentage of the GHS8 billion.

MTN has challenged the tax liability and has been given 21 days to negotiate with the GRA in that regard. The telecoms giant also has the opportunity to seek redress in court if the negotiation does not prove satisfactory.

The implications of this liability slapped on MTN are more than just financial. There is the issue of reputational damage if indeed they hid revenue from the state; and there is also the issue of criminality if indeed they evaded taxes as is being alleged. It is possible some current and former MTN Ghana staff might go to jail if this matter is pushed to its logical conclusion.

But who are Safaritech, and what did they say about themselves to make GRA choose them over the highly-reputed KPMG?

First of all, as stated above, Safaritech claims to be a UK-based Kenyan auditing and consulting firm, which is an agent of the IMF and also sponsored by the World Bank and USAID among others. Within the context of Ghana going to the IMF with cup-in-hand for $3 billion to assist the country deal with its bankruptcy, it is not a surprise for GRA to have chosen a self-styled IMF agent, Safaritech’s audit report over that of KPMG.

Per its own “Who We Are” on its website, Safaritech Ghana said it comes with a vaunt of experience spanning 20 years (Since July 13, 1998) in audit and investigation of compliance systems of Revenue Authorities and Telecom companies in 31 countries with inordinate success in partnership with IMF/World Bank, USAID and others.

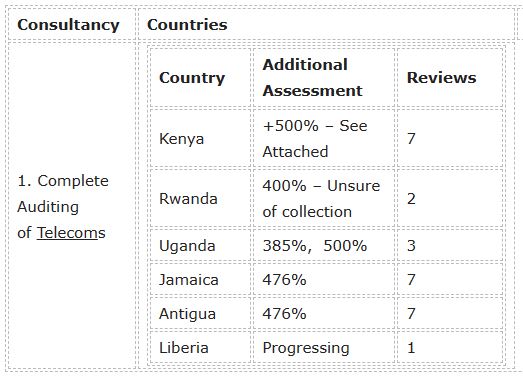

The countries where Safaritech alleges to have provided the kind of telecoms auditing services it did in Ghana are its home country Kenya, Rwanda, Uganda, Jamaica, Antigua, and Liberia.

According to Safaritech, all of these exercises/contracts were either sponsored by the revenue authority of the respective countries and or by IMF and USAID, and it achieved between 385% and over 500% incremental tax revenue across board. That is significant.

Beside telecom auditing and tax compliances solutions, Safaritech also claims to be involved in telecom training, research and sizing in Senegal, Togo, Benin, Guinea Bissau, Guinea Conakry, Mauritania, Burkina Faso, Ivory Coast, Kenya, Niger, Nigeria, Mali, Malawi, Rwanda, Tanzania, Zambia, Liberia and Ghana, all sponsored by International Monetary Fund (IMF) and the respective revenue authorities.

Safaritech also said it works as specialized consultants in the design and implementation of overall Electronic Tax Devices for retail VAT collection. The table below show their footprints in that area, and it includes Ghana, since 2016.

| Country | Status | Additional VAT, Excise |

| Kenya | 2004 – Model | 444% |

| Ethiopia | 2004 – Non- EFDMS | 66% |

| Tanzania | 2009 – The BEST | 2855% |

| Rwanda | 2012 – Upgrading | – |

| Ghana | 2016 – Contractor | – |

| Mozambique Malawi Zimbabwe | 2015 – Contractor 2014 2016 |

The company did not stop there. It also claims to be involved in Training or Research, Piloting, Sizing, Installation and functioning maintenance of Electronic Tax Devices on traders POS in Egypt, Kenya, Ethiopia, Rwanda, Tanzania, Mauritius, Mozambique, Zimbabwe, India, Malawi, Burundi, Jamaica, Nigeria, Gambia, Ghana, Malawi, S/Leone, Bangladesh, South Africa and Malaysia.

According to Safaritech, its electronic tax devices, equipment and software relevant for Africa are manufactured in Bulgaria, Japan, Turkey, Greece, Serbia, France, Italy, Dubai, China and India.