Kenyan loan company, WhitePath Company Limited and workspace provider Regus Kenya are feeling the heat for not playing by the data protection rules, Techweez reports.

Each company has been slapped with a hefty penalty of Ksh5 million ($37,000) as per the Data Protection Act and Complaints Handling Procedure and Enforcement Regulations.

It turns out that WhitePath has been receiving a barrage of complaints, with close to 150 users claiming that their applications have been accessing their phone contacts without permission and bombarding them with unwanted text messages.

To make matters worse, WhitePath’s staff has allegedly been harassing the complainants and their contacts.

As for Regus Kenya, they’ve been accused of spamming improper information to a complainant despite attempts to make them stop.

They suffered such an expensive penalty for refusing to cooperate with the Office of the Data Protection Commissioner (ODPC).

According to the ODPC, WhitePath failed to comply with an enforcement notice dated January 10, 2023, while Regus Kenya was non-cooperative and ignored multiple complaints, reminders and an enforcement notice.

The Data Commissioner, Immaculate Kassait, sternly emphasised that it’s the responsibility of every company to prioritise protecting personal data and challenged businesses to do so by design and by default.

Ghana

In Ghana, several unlicensed digital lenders are abusing the data of Ghanaian but very little has been done to stop them, except public notices issued by the Bank of Ghana and the Cybersecurity Center.

Bank of Ghana cautioned the public against some 19 unlicensed digital lenders and also sanctioned some payment service providers for allowing those 19 to use their payment gateways.

Also Read: DatesCash App imposes loan on user, demands 80% interest in two weeks

But there are still some unlicensed digital lenders like DatesCash, which are still operating in earnest and are abusing people’s data and also engaging in unlawful loan advancement practices.

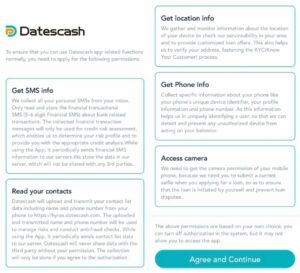

The picture below shows the extent to which DatesCash has institutionalized data abuse by their App. They demand access to almost every private information on a user’s phone.

Bank of Ghana has given assurance that it is working on a holistic approach that will ensure that, not only would companies like DatesCash be weeded out, but that they will also not be able to hide anywhere on the globe and continue their illegal and illegitimate activities.

Also Read: Google bans personal loan apps from accessing user contacts